irs child tax credit phone number

Find answers about advance payments of the 2021 Child Tax Credit. 15 but the millions of payments the IRS has sent out have not.

Arizona Families Now Getting Monthly Child Tax Credit Payments

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. Since the child tax credit questions and troubles are related to individual taxes you need to call the agencys appropriate phone number. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code.

The Child Tax Credit Update Portal is no longer available. The IRS telephone number is 1-800-829-1040 and they are available from 7 am. For example if you call the IRS business phone.

It is a tax law resource that takes you through a series of questions and provides you with responses. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Request for Transcript of Tax Return.

Taxpayers whose income is 73000 or less qualify for IRS Free. Have Child Tax Credit or Other Tax. The toll-free number for the IRS is 800-829-1040 and representatives are available 7 am.

Here are some numbers to know before claiming the child tax credit or the credit for other dependents. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Have been a US.

Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls. Heres the Direct phone number for CTC questions or help. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls.

To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

The number to try is 1-800-829-1040. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. The amount of credit you receive is based.

Advance Child Tax Credit. Make sure you have the following information. The maximum amount of the child tax credit per qualifying child.

The number to try is 1-800-829-1040. 800-908-4184 is the direct phone number specifically for questions or help with the child tax credit. Choose the location nearest to you and select Make Appointment.

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income AGI is greater than 73000. Contact an International IRS Office. Local time Monday thru FridayAccountant Amy Northard offers this cheat-sheet for.

They can only answer. Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021.

Irs Cp 79a Earned Income Tax Credit Two Year Ban

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Irs Unveils Address Change Feature For September Payment

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

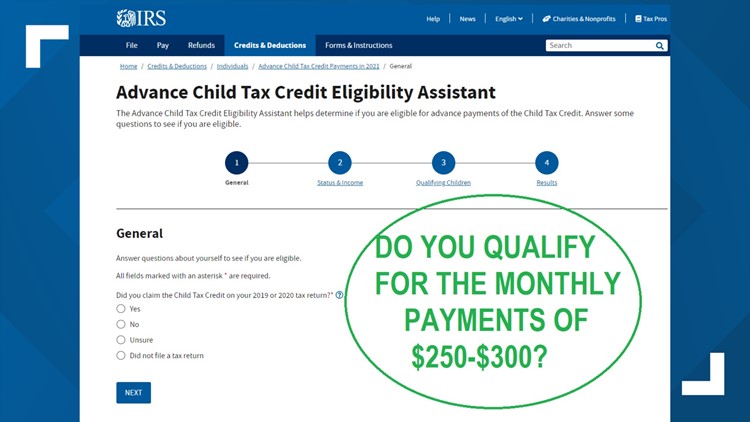

Irs Child Tax Credit Portal Open For Parents Who Want To Opt Out Of The Monthly Payments 5newsonline Com

Child Tax Credit Scam Warning From Irs Signals Az

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Irs Beware Of Scammers Trying To Cash In On Child Tax Credit Payments

How To Contact The Irs About 3 000 To 3 600 Child Tax Credit As Usa

Telephone Assistance Internal Revenue Service

Advance Payments Of The Child Tax Credit The Surly Subgroup

Be Wary Of Child Tax Credit Scams Forbes Advisor

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Telephone Assistance Internal Revenue Service

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com